REPORT BY THE CHIEF EXECUTIVE OFFICER TO THE BOARD OF DIRECTORS ON THE RESULTS OF THE FISCAL YEAR OF 2021

The consolidated sales of Grupo Carso reached the amount of $124,573 million pesos, growing by 31.6% compared to 2020. This increase is explained primarily by the performance of Grupo Sanborns, which represents 42.5% of the total revenue and which increased by 35.0% due to the recovery of sales in its department stores after the COVID-19 pandemic. The other divisions, such as Condumex, also increased their sales, due to the greater demand for cables and automotive harnesses. In Carso Infraestructura y Construccion sales increased by 3.8% for drilling services and the inclusion of the Tren Maya project, compensating for the completion in the construction of offshore platforms. Additionally, the Carso Energy Division, which represents 2.4% of the company’s total revenue, increased by 228.4% from the startup of the Samalayuca-Sasabe gas pipeline (100% owned by the Group), as well as from the acquisition of the two hydroelectric plants in Panama the previous year.

The operating profit increased by 44.2%, from $8,916 million pesos in 2020 to $12,857 million pesos in 2021. The principal reason for this increase is because of the greater profitability in Grupo Sanborns, which grew by 59.6% because of the greater number of shoppers in the stores after the pandemic, added to a greater operating profit in Grupo Condumex, which increased by 45.0% and in Carso energy, which went from a loss of $183 million pesos to a profit of $1,901 million pesos. On the other hand Carso Infraestructura y Construcción, which has already taken into account the rehabilitation services of the collaboration agreement with the government of Mexico City (GCDMX) and with the collective Transportation System (STC-Metro) to realize rehabilitation works of line 12 of the Metro, decreased by 60.8%.

The accumulated EBITDA totaled $15,724 million pesos, increasing by 40.3%. For the calculation of this indicator, extraordinary items or items that do not imply cash flow, such as the reappraisal of investment properties, are not considered. The corresponding EBITDA margin was 12.6%, compared to 11.8% in the previous year.

The integral result of financing was an expenditure of $751 million pesos, which was greater than the expenditure of $587 million pesos the previous year. This was due to greater amounts of net interest paid in 2021, since the exchange results remained constant up to last year.

The controlling net profit was in the amount of $11,282 million pesos, increasing by 97.7% compared to the profit of 2020, which was $5,706 million.

The total debt on December 31 was $24,151 million pesos, basically consisting of the financing for the Samalayuca-Sásabe gas pipeline, the debt contracted for the acquisition of Ideal Panamá, acquired in February of 2021, and a stock certificate for $3,500 million pesos, issued in 2020. The total debt was similar to the debt at the close of the previous year, which was $24,111 million pesos.

The net debt is $12,954 million pesos, compared to the net debt of $9,705 million pesos on December 31 of 2020. The total amount of cash and cash equivalents was $11,198 million pesos, compared to $14,406 million at the end of December of 2020.

The financial position of Grupo Carso shows a net debt to 12 months EBITDA ratio of 0.82 times, compared to 0.87 times in 2021. The coverage of interest index, measured as Interest Paid/EBITDA was 0.11 times.

At the present time, and since February 17 of 2017, the Company has a dual bond certificates program in the amount of $10,000 million pesos, with an issue for $3,500 million pesos on March 13 of 2020 with an expiration date of 3 years.

Total Debt

(million pesos)Capital Expenditures

(million pesos)Net Debt/EBITDA

(times)COMMERCIAL

AND CONSUMER DIVISION

Sales

(million pesos)Operating Income

(million pesos)EBITDA

(million pesos)Sales by Format

Grupo Sanborns

During 2021 the sales of the commercial and consumer division totaled $52,939 million pesos, which was $13,735 million pesos more than in 2020, representing an increase of 35.0%. In Sears, Sanborns and Promotora Musical (IShop-Mix Up), a recovery that began in March was observed, with a greater influx of shoppers in the commercial centers and department stores. Sales and services to customers were further increased through online shopping. The net credit portfolio reached a total of $11,032 million pesos on December 31 of 2021, increasing by 7.9%.

The operating profits surpassed the amount of $1,681 million pesos obtained in 2020 to reach a total of $2,683 million in 2021, an increase of 59.6%, attributable to the increased sales mentioned above and a greater share of sales in fashion items and in the restaurants. Additionally, the operating and administration expenses in proportion to sales were reduced from 33.9% to 28.1%.

The annual EBITDA of Grupo Sanborns increased 131.5% in 2021, from $2,041 million pesos in 2020 to $4,724 million pesos in 2021. This is without taking into consideration Other Net Income in 2020 in the amount of $1,470 million pesos, originating mainly from the valuation of labor obligations from the updating of the employee pension plan.

The controlling net profit of Grupo Sanborns increased by 150.0% to a total of $1,819 million pesos, compared to $727 million pesos in 2020. This increase was obtained because of the previous results as well as because of a lower integral financing cost due to a reduction in the net interest paid and a lower exchange rate loss than in the previous year.

Grupo Sanborns’ capital investments were for a total of $369 million pesos. Towards the end of December it was operating 433 units in the various formats, with a sales floor area of 1,191,306 square meters.

THE INDUSTRIAL

AND MANUFACTURING DIVISION

Grupo Condumex

During 2021 the sales of Grupo Condumex increased by 34.4%, totaling $44,259 million pesos, compared to $32,937 million pesos recorded the previous year. This was primarily due to the favorable effects of the average peso/dollar exchange rate, combined with the recovery in the volumes of sales in most of the manufacturing plants of the Cables sector, such as in the copper telephone cables plant, the fiber optic and coaxial cables plants, and increased exports to Europe and South America. In auto parts, the balance for the year was positive, overcoming the stoppages that occurred in our clients’ plants due to the shortage of chips, among other reasons. In the construction division, a greater dynamism was observed in the markets, which produced an increase in the sale of construction cables.

The operating profits and the EBITDA totaled $5,970 y $6,027 million pesos, representing increases of 45.0% and 29.5%, respectively, compared to the 2020 figures. This was due to the greater sales volumes mentioned above, as well as to the average 51.4% higher price of copper during the year.

As for the net controlling profits of Grupo Condumex, they improved by 105.9% for a total of $5,366 million pesos, compared to $2,606 million pesos in 2020.

The capital investments by Grupo Condumex during the year totaled $598 million pesos, and they were carried out mainly for the purpose of maintaining the Group’s industrial plant in an optimal condition and for improvements with the use of new technologies.

Sales

(million pesos)Operating Income

(million pesos)EBITDA

(million pesos)INFRASTRUCTURE

AND CONSTRUCTION DIVISION

Sales

(million pesos)Operating Income

(million pesos)EBITDA

(million pesos)Annual Backlog*

(million pesos)*Amount of contracting works pending to be built

Carso Infraestructura y Construcción

Carso Infraestructura y Construcción sales increased 3.8% to the amount of $25,472 million pesos during 2021, compared to a total of $24,542 million pesos the previous year. The increase in sales is explained mainly by the services and materials provided by the Manufacturing and Services Division to the chemical and petroleum industries, such as in the greater number of exploration wells and deep wells drilled for Pemex. The performance of the Infrastructure and Construction Division improved because of the inclusion of the Tren Maya Section II project, in addition to the increased production in Mitla Tehuantepec. These business segments compensated for the reduction in sales of the other divisions as the result of the completion of projects, as was the case in the completion of the Civil Construction and Housing works and the completion of the Maloob E-1 platforms and the Samalayuca-Sásabe pipeline.

A greater return was seen in the operations of the Fabricación y Servicios Division for the chemical and petroleum industries from the drilling works mentioned. However, for Carso Infraestructura y Construccion the overall operating profits and the EBITDA decreased by 60.8% and 49.8%, respectively, when the expected cost of the rehabilitation services of the Metro Line 12 of the CDMX is taken into account.

As for the net controlling profits, they went from $2,211 million pesos in 2020 to $456 million pesos in 2021, a drop of 79.4%.

The principal projects in progress at the end of 2021 include the construction of the Las Varas-Vallarta and Mitla-Tehuantepec highways; the Telecommunication facilities services; equipment for the petrochemical industry; various drilling services for the petroleum industry, and the section II part (Escárcega-Calkiní) of the Tren Maya railroad.

Carso Infraestructura had a total backlog of $48,893 MXN on December 31 of 2021, compared to a total of $48,313 MXN in the same period the previous year.

The investments in fixed assets carried out by Carso Infraestructura y Construcción during 2021 were in the amount of $463 million pesos.

ENERGY

DIVISION

Carso Energy

The sales of Carso Energy in 2021 were for $2,994 million pesos, an increase of 228.4% over the $912 million pesos recorded the previous year. This increase was attributable to the revenue from the two hydroelectric plants in Panama, which were acquired in 2020, and to the startup of the Samalayuca-Sásabe gas pipeline.

The increase in revenue mentioned was reflected in the improvement in the operating results, which went from a loss of $183 million pesos to a profit of $1,901 million pesos this year. The accumulated EBITDA improved by 306.7%.

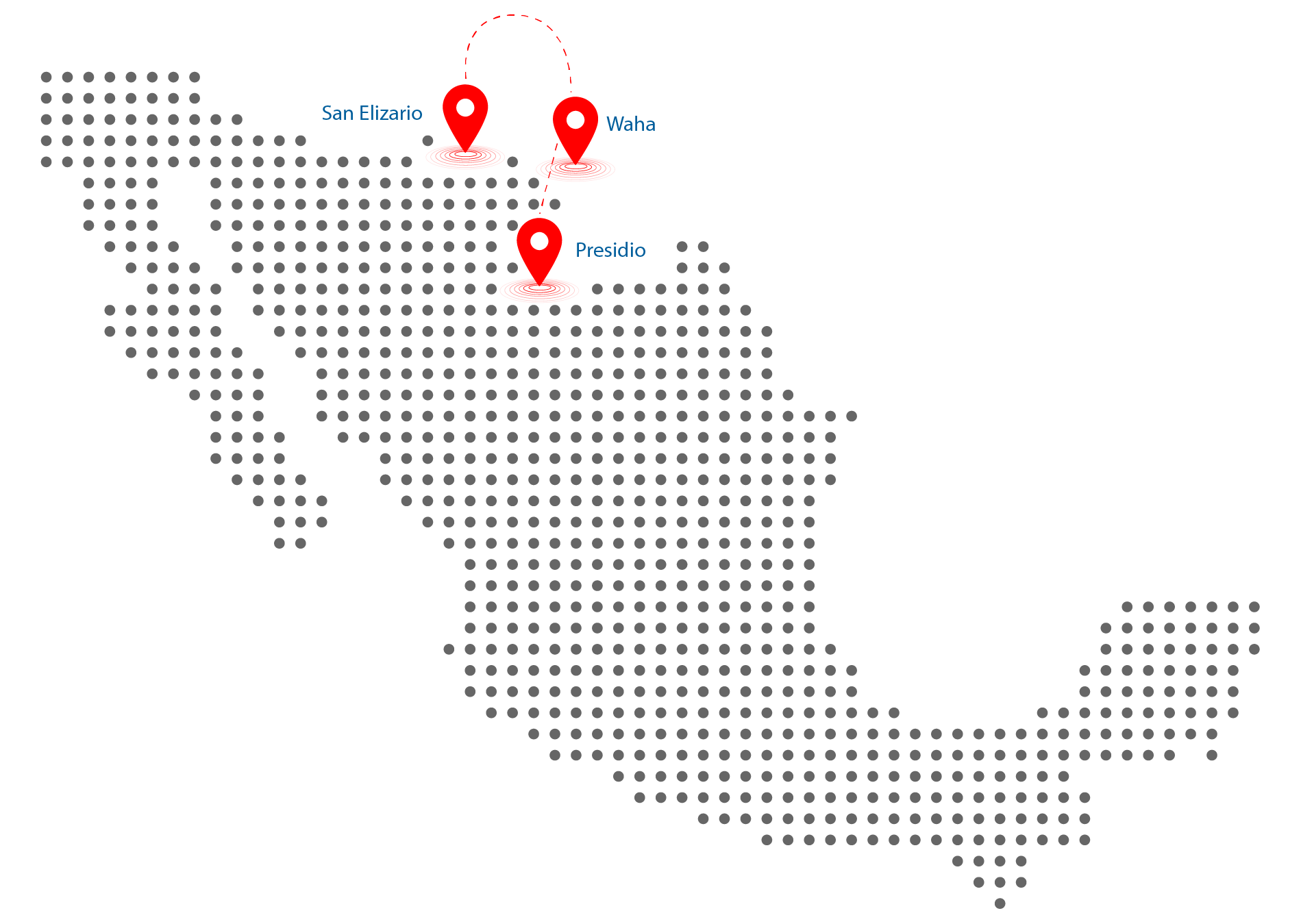

The Waha-Presidio and Waha-San Elizario gas pipelines, both located in Texas, U.S.A. and in which we hold a 51% share, reported significant revenue and profits during 2021. But they are not consolidated with Grupo Carso and therefore they are not reflected in the operating results of this division but rather in the results of associated companies.

The net results of the energy sector were for $2,050 million, compared to $735 million in 2020, an increase of 178.8% based on the previously mentioned results as well as on the participation of the gas pipelines in Texas and on the effects of the exchange rate.

The construction of the part of the Samalayuca-Sásabe pipeline located between the states of Chihuahua and Sonora was concluded in 2021. Grupo Carso has a 100% share of the project, which became available for the transmission of gas to the Federal Electricity Commission (CFE) in April of 2021. The investment in a compression station to greatly increase the transmission capacity of the said pipeline has been initiated.

The exploration of the two geothermal energy fields in the states of Baja California and Guanajuato, to which Carso contributed 70% of the capital, was suspended largely as a result of the pandemic.

No new investments in fixed assets were carried out by Carso Energy in 2021.

Sales

(million pesos)Note: As of 2017 Carso Energy does not reflect revenues generated by the Jack-Up "Independencia I" but revenues from the production and sale of oil through Tabasco Oil Company. In 2018, Other Expenses of $373 million pesos were recorded in exploration investments in the Colombian fields. In 2021, through its indirect subsidiary Carso Energy Corp, Carso Energy acquired from Promotora del Desarrollo de América Latina, S. A. de C. V., 100% of the shares representing the capital stock of Ideal Panamá, S. A. (Ideal Panama), thus obtaining control of it. The main activities of Ideal Panamá consist of the generation and commercialization of electric energy, as well as the operation and maintenance of hydroelectric plants.

Operating Income

(million pesos)EBITDA

(million pesos)Associated Companies

Grupo Carso has important investments in companies of different industries, such as in Fortaleza Materiales y Elementia Materiales (cement and construction materials), in which it holds 38.7%; GMéxico Transportes, S.A.B. de C.V. (Railroad), 15.1%; Infraestructura y Transportes México, 16.7%; Transpecos Pipeline L.L.C., and Comanche Trail Pipeline L.L.C., which manages the Waha–San Elizario and Waha–Presidio pipelines in Texas, U.S.A.. 51.0%; and 14.0% in Inmuebles SROM, S.A. de C.V., a real estate Company that owns commercial strips in Mexico.

The sales and EBITDA of these companies that would proportionately correspond to Grupo Carso in 2021 were $23,786 and $7,047 million pesos.

Sincerely,

Engr. Antonio Gómez Garcia

Chief Executive Officer